Impact Investing: Big Society Capital

By Lena Dominici

Introduction

Is it possible to address the world’s social problems while still making a financial return? Impact investing seeks to achieve this goal. Big Society Capital is a wholesale investment bank that invests in social investment intermediaries, which then invest in social enterprises and charities to address social issues. Impact investing is increasingly popular but faces several challenges.

I. Impact Investing

a. Definition of impact investing

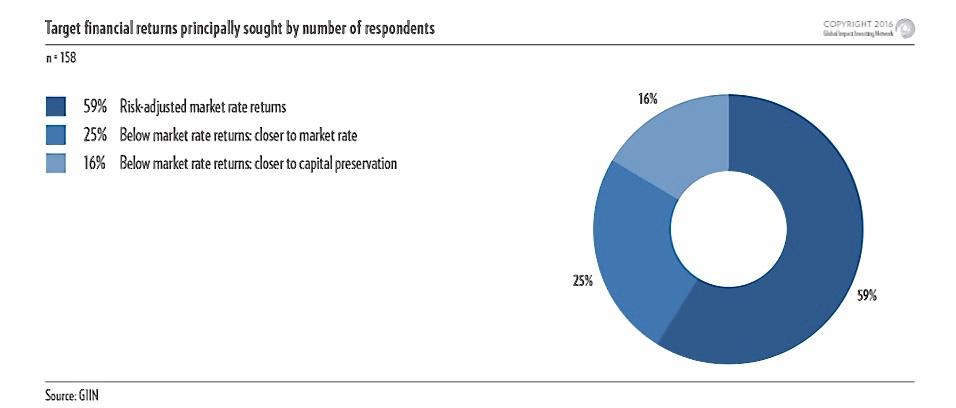

When the Rockefeller Foundation invited leaders in finance, development, and philanthropy in 2007 to the Foundation’s retreat center in Bellagio, participants coined the term “impact investing.” Impact investing does not solely focus on providing financial resources for a financial return but also aims at a positive social and environmental impact.[1] Today, the definition of impact investing remains broad. The Global Impact Investing Network (https://thegiin.org) states that impact investments are “investments made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending upon the circumstances.” [2]

Impact investing should satisfy three key measures:

- Intentionality: objectives should be clearly articulated across financial and social goals

- Measurement: impact across both objectives should be measured

- Transparency: the organisation should share information on its progress and performance[3]

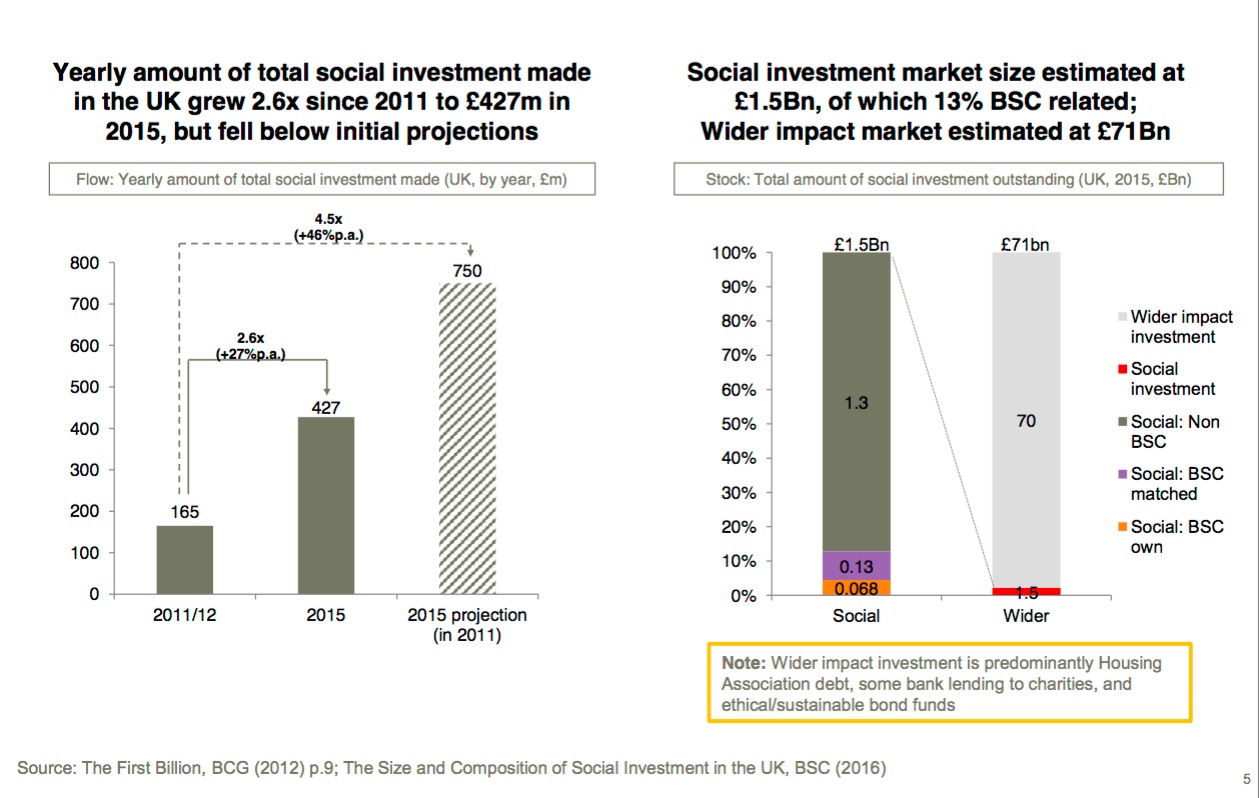

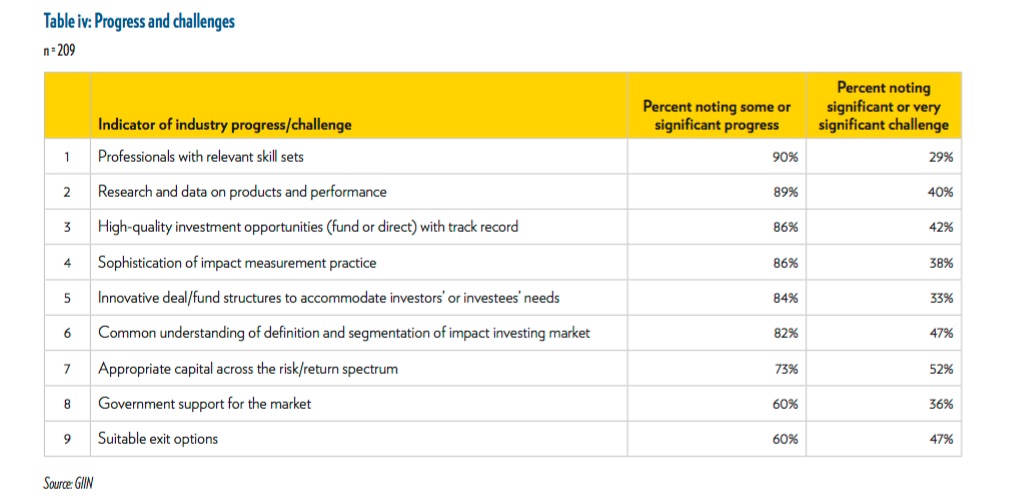

Because the definition of impact investing is broad, the size of this market has not been yet fully quantified, but there is evidence the impact investing industry is growing.[4]

Many people today are keen on making the world a better place: impact investing is a way to finance innovative solutions to global issues such as healthcare or social housing.

2. Terminology: difference between social investment and impact investing

The term social investment is commonly used as a synonym for impact investing both in academic and in practitioner literature. Yet, social investment is a narrower concept. In the case of Big Society Capital, social investment is treated as a subgroup of impact investing.

There seems to be no consensus on definitions of impact investing and social investment. Working towards clearly defined definitions allows more clarity and effectiveness.

b. Performance of impact investing

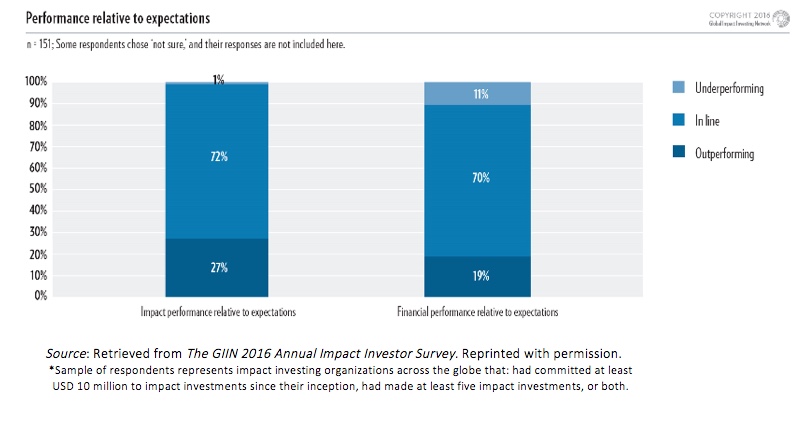

In 2017, most respondents of the GIIN Annual Impact Investor Survey reported that their investments have either met or exceeded their expectations for both impact (98%) and financial performance (91%).[5]Financial return expectations vary according to the impact investors’ expectations. Some invest for below-market-rate returns while others pursue market-competitive and market-beating returns. The investors surveyed by the GIIN in 2016 claimed to pursue competitive returns. According to the GIIN, portfolio performance meets or exceeds investor expectations for “both social and environmental impact and financial return, in investments spanning emerging markets, developed markets, and the market as a whole”[6]

The Impact Investing Benchmark (IIB), launched by Cambridge associates and the Global Investing Network, draws similar conclusions. The IIB is an analysis of the financial performance of market rate private equity and venture capital impact investing fund. The Impact Investing Benchmark is composed of 51 private investment funds.

Some investors tend to think the return on impact investing must be below market-rate return. Yet, in aggregate, impact investments launched between 1998 and 2004 outperformed funds in a comparative universe of conventional private investment funds.[7]

II. A case study of impact investing: Big Society Capital

a. The idea of a “Big Society”

David Cameron, the UK’s former Prime Minister, launched the initiative of a Big Society in 2010. This political ideology has three stated priorities:

- People more involved in their communities

- People being able to contribute more effectively through a stronger social sector

- People better able to shape governmental policy and delivery

These priorities are needed to reconfigure how policy is developed and delivered.

Big Society’s purpose is to build a more productive and responsive government and a more self-reliant and participative society. New policies would achieve better outcomes in welfare, education, health, cohesion, and crime reduction.[8]

The Big Society concept initiated the creation of Big Society Capital (BSC), established in 2012 to help accelerate the development of impact investing in the UK. It got support across the political spectrum: the idea emerged under the Labour Party, whilst it was launched under the Conservative and Liberal Democrat coalition government.

Big Society Capital was set up to grow the social investment market in the UK. It is different from a regular investment bank as it focuses on impact investing: BSC invests in intermediaries that invest in social enterprises and charities.

The goal is to encourage investors to lend or invest money to attain a financial as well as a social return. BSC and its co-investors have invested over £270 million in organisations that lend money to social enterprises and charities.[9] A social enterprise is a revenue-generating entrepreneurial organisation with two aims:

– achieving a financial return; and

– achieving social, environmental, cultural, and community economic outcomes[10]

One of the main challenges of social enterprises and charities is the lack of funding opportunities. The financial crisis taught us the infrastructure of the financial market is crucial to its functioning: without transparency and effective tools for rating, investors cannot distinguish between good and bad investments. Tools to evaluate social risks and returns have only been developed recently. The lack of market machinery to evaluate social risks and returns can have two effects:

- it leaves good social enterprises and charities without funding; and

- investors stay focused solely on financial returns.[11]

BSC provides funding to these social enterprises. BSC gets its funds from two streams:

- English dormant bank accounts: “it is anticipated that Big Society Capital will receive up to £400 million from the Reclaim Fund Ltd (a wholly owned subsidiary of the Co-operative Banking Group) which collects dormant bank and building society account monies from UK banks and building societies”

- The four main UK high street banks: HSBC, Barclays, RBS and Lloyds Banking Group. The banks’ contributions are limited to £200 million over five years.[12]

b. Organisational structure: the governance structure around BSC

Dormant accounts

The Dormant Bank, along with the Building Society Accounts Act 2008, enabled banks to voluntarily hand over to a reclaim fund any monies left unclaimed in dormant accounts for over 15 years. The Reclaim Fund’s aim is to distribute surplus monies for good causes and always hold sufficient funds to meet reclaims in perpetuity.

The Big Lottery Fund

The Big Lottery Fund assigns the money received from the Reclaim Fund to United Kingdom home countries (Northern Ireland, Scotland, England and Wales) using the Barnett Formula, which is a standard weighting used by the British Government.

Big Society Capital’s owners

The owners of BSC are (1) Big Society Trust and (2) Shareholding Banks.

Big Society Trust ensures BSC remains true to its mission. The Trust buys “A” shares from BSC using the monies it receives. The “B” shares are purchased by shareholder banks: Barclays, Lloyds, HSBC and RBS. Each bank’s investments remain at 10% of the capital and Big Society Trust contributes 60% of the total capital. The banks’ commitment is limited to £50 million each. At shareholder meetings, each bank has agreed to cap its voting rights to 5% of the overall voting rights.

Big Society Capital Board has two committees comprising non-executive Board and external members with specific expertise.

- The Audit, Risk and Compliance Committee, which oversees management processes, and ensures the effectiveness of systems and controls, including risk management.

- The Nominations and Remuneration Committee, which makes recommendations regarding the appointment of directors

Operational Committees

The executive committee is responsible for the day-to-day administration of BSC. The investment committee makes investments and is responsible for the performance of BSC’s portfolio of investments. The valuation committee determines valuations and assesses investment performance.[13]

Investments

As an investor, BSC supports social investment finance intermediaries. Many social enterprises and charities can find it difficult to access repayable finance. BSC expects to have £600 million of capital to invest in intermediaries to help social change.

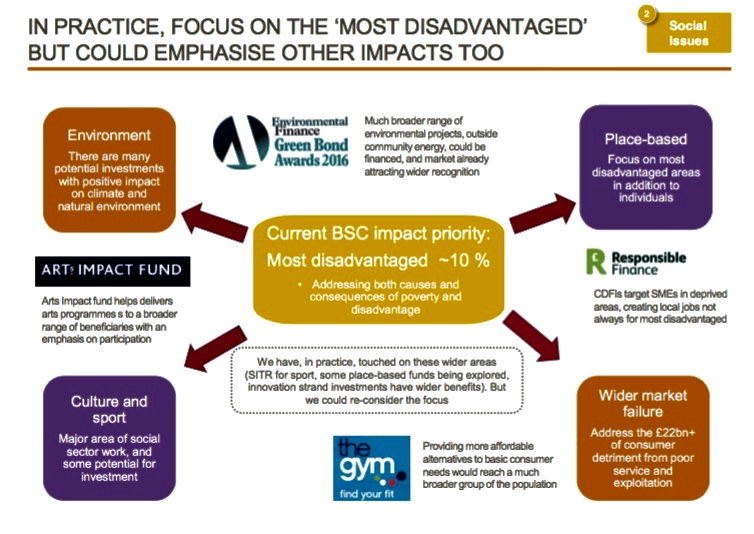

BSC cannot invest directly in charities and social enterprises. It invests in social investment finance intermediaries (SIFIs) such as fund managers that in turn provide finance and support to social enterprises and charities. Only SIFIs providing finance to “Social Sector Organisations” are eligible for investment by BSC. Social sector organisations exist to provide benefits to society. Through their investments, BSC aims to show that social investment is sustainable.

BSC is looking for investments that deliver social impact. Many of those investments have the following characteristics:

- Clear social mission and articulation of how activities will deliver impact (theory of change)

- Well-evidenced understanding of the people who will be impacted by the investment and their needs

- Impact delivered is more than would be achieved without the intervention

- The model (and impact) can be replicated or scaled

- The solution is innovative, in that it addresses the problem in a new or better way

- Achieves the best result for beneficiaries considering the amount of capital relative to alternative ways of tackling the problem (the impact yield)

BSC assesses investments using a pre-diligence followed by a due diligence screen to assess the social impact of potential investments. Due diligence is an investigation of a potential investment prior to signing a contract, such as reviewing financial records. During the due diligence process, BSC explores how the intermediary will reach charities and social enterprises and reviews its fund-raising plans. To assess financial stability, BSC reviews the business plan and financial model and runs sensitivities to test how resilient the financial case is in the event of underperformance or external market shocks. [14]

III. The challenges faced by Big Society Capital

a. It is hard to measure the impact of social investment

How does BSC measure the impact of its investments in social enterprises and charities?

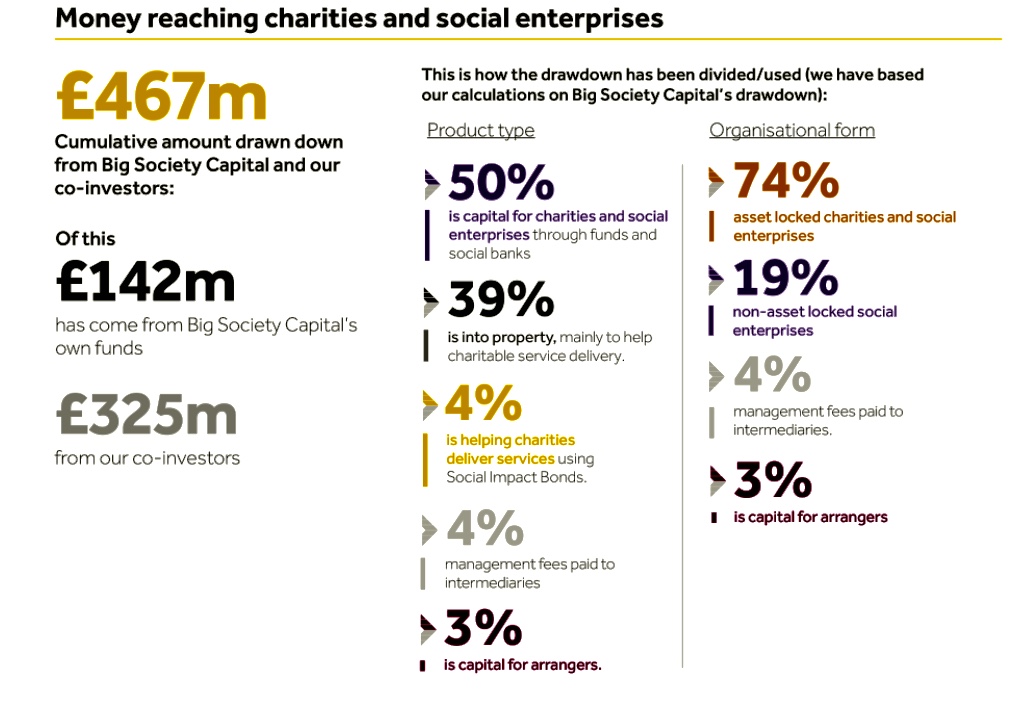

BSC developed a range of key performance indicators (KPIs) that it uses to evaluate and monitor both the social investment market and the organisation’s performance using KPIs such as “money available to charities and social enterprises and money reaching charities and social enterprises.”

The Outcomes matrix is a tool to help organisations measure their social impact by including measures for nine outcomes areas. Every organisation can create its own Outcome matrix. To try it, follow this link: http://www.goodfinance.org.uk/impact-matrix

b. The need for effective market machinery to evaluate social risks and returns

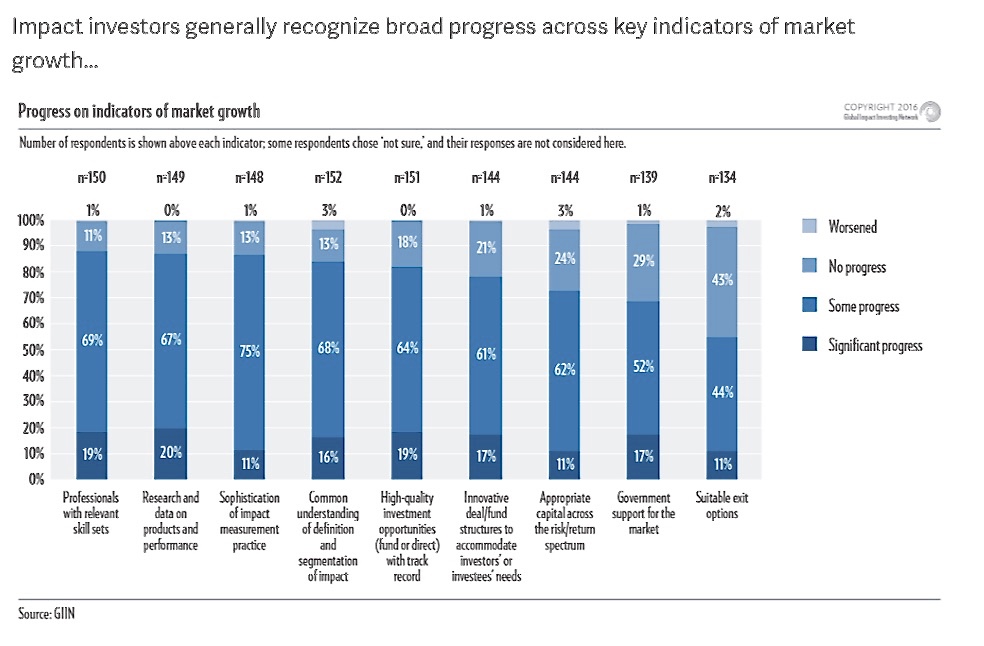

The effectiveness of impact investing relies crucially on the development of transparent ways to measure, report, and monitor social outcomes by the social sector. The GIIN seeks to establish criteria for “double-bottom-line investing,” where the first line is financial and the second is social. The GIIN Impact Reporting and Investment Standards are common standards for reporting social outcomes (just as GAAP provides a way of comparing investment options).[15]

Transparency in the social investment market will improve the understanding of its activities. Wider information on BSC’s processes enables stakeholders to better understand how BSC operates. For example, BSC is committed to publish its portfolio breakdown across geography and sector twice a year and publish details on operational costs along with the annual report. Transparency is crucial in finance, as fuller disclosure helps win more trust from the investor. Reliable information represents less risk to investors, which translates into a lower cost of capital and thus higher valuations.[16]

Conclusion

Impact investing is on the rise and Big Society Capital’s project raises the profile of social enterprises and charities in the UK, and contributes to solving problems through finance and investments.

Impact investing needs to further develop ways to measure impact: the more data are available the more investors are encouraged to invest in social enterprises and charities. There is evidence of impact investing’s strong performance, but the upper bounds of impact investing are yet to be seen. BSC may be setting up a trend by adopting social investment strategies. After only five years, BSC has helped improve understanding of social investment. It plays an important role in developing the social investment market by increasing available funding for social enterprises and charities. In sum, BSC will continue to have a positive influence on the impact investing sector.

-x-

[1] What’s in a Name: An Analysis of Impact Investing Understandings by Academics and Practitioners

Anna Katharina Ho ̈chsta ̈dter. Barbara Scheck p1

[2] http://www.theimpactprogramme.org.uk/what-is-impact-investment/ The impact programme, UK aid

[3] https://www.bigsocietycapital.com/latest/type/blog/education-activation-exploring-rockefeller-brothers-fund’s-journey-impact-investing)

[4] https://thegiin.org/assets/GIIN_Impact%20InvestingTrends%20Report.pdf

[5] https://thegiin.org/assets/GIIN_AnnualImpactInvestorSurvey_2017_Web_Final.pdf

[6] https://thegiin.org/impact-investing/need-to-know/#s5

[7] http://40926u2govf9kuqen1ndit018su.wpengine.netdna-cdn.com/wp-content/uploads/2015/06/Introducing-the-Impact-Investing-Benchmark.pdf p i

[8] Cabinet Office https://www.instituteforgovernment.org.uk/sites/default/files/Building_the_big_society_lord_wei.pdf

[9] http://www.bigsocietycapital.com/sites/default/files/UK%20Social%20Investment%20-%20Opportunities%2C%20Challenges%2C%20and%20Critical%20Questions.pdf

[10] http://www.centreforsocialenterprise.com/what-is-social-enterprise/

[11] https://hbr.org/2012/01/a-new-approach-to-funding-social-enterprises

[12] https://www.bigsocietycapital.com/faqs

[13] https://www.bigsocietycapital.com/about-us/governance

[14] https://www.bigsocietycapital.com/what-we-do/assessment-and-co-development

[15] https://hbr.org/2012/01/a-new-approach-to-funding-social-enterprises

[16] http://www.investopedia.com/articles/fundamental/03/121703.asp